Professional Experience

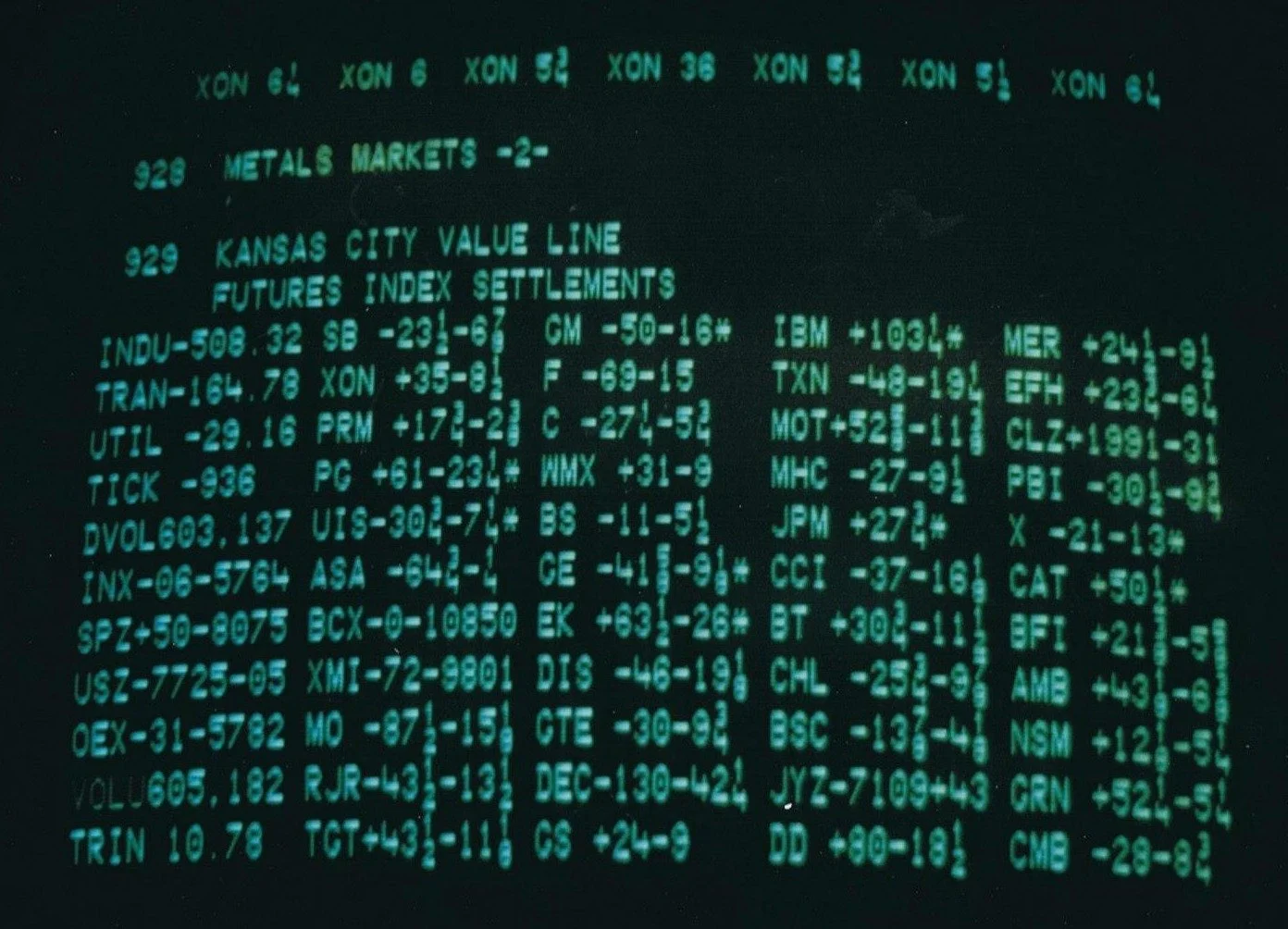

Black Monday-October 1987

Managing risk and protecting capital in real time as markets fall more than 20%

Capital Markets & Crisis Experience

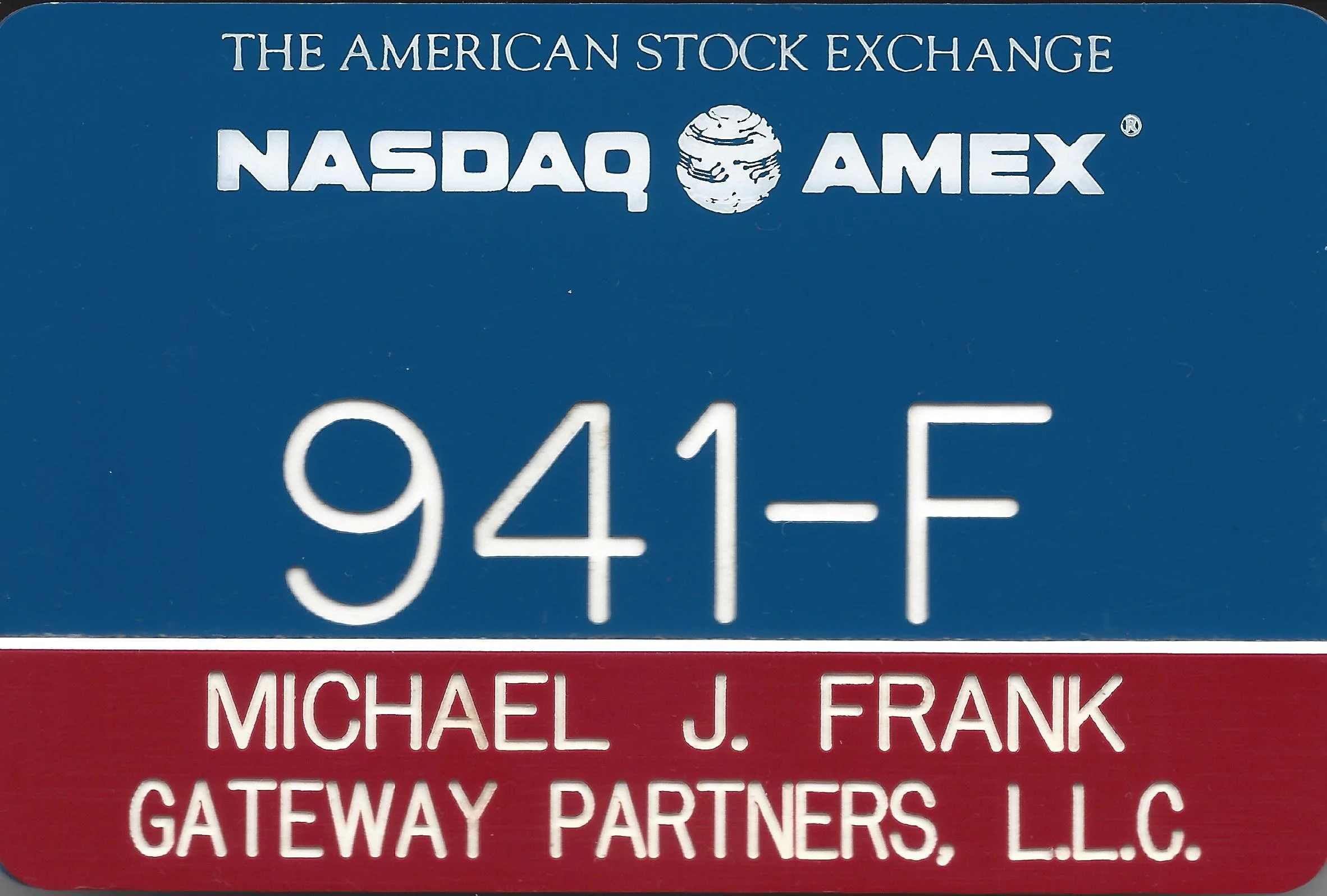

Market Maker & Specialist Unit

American Stock Exchange (AMEX)

Philadelphia Stock Exchange (PHLX)

Managed capital and risk across multiple structural market disruptions, including:

1987 crash · LTCM · Dot-com unwind · 9/11 · 2008 Financial Crisis · Flash Crash

These events shaped a durable operating philosophy:

Liquidity disappears faster than models suggest

Correlations converge under stress

Incentives drive behavior more than forecasts

Structure and discipline matter more than prediction

The experience of managing capital during multiple structural market disruptions shaped a lasting principle:

Risk must be understood in real time — not reconstructed after the fact

Experience operating within regulated exchanges and complex capital structures provides perspective

directly applicable to public companies, private equity portfolio companies, ESOP-owned businesses,

and multi-generational family enterprises

Founder, Operator & Capital Steward

Founded Gateway Partners, a market-making and specialist firm, registered

broker-dealer and a member firm of all U.S. options exchanges

Architected and built the Gateway Trading System (GTS) — a proprietary derivatives

valuation and firm-wide risk infrastructure platform providing real-time

exposure visibility across nearly 500 securities

Successfully exited to a NASDAQ-listed company

Hands-on experience with:

Building regulated financial infrastructure

Capital formation and balance sheet discipline

Scaling teams in volatile environments

Supervisory and compliance oversight

Strategic transaction execution and exit

This was capital at risk — not advisory from the sidelines

Technology, Governance & Long-Term Capital

Advise fintech and technology companies on governance, risk, and disciplined growth

Founder of Gildre — an operator-led global knowledge network strengthening founder judgment,

strategic execution, and long-term enterprise building

Support venture capital firms, accelerators, and long-horizon capital partners through:

Founder mentoring and leadership calibration

Governance and board effectiveness guidance

Portfolio-level risk perspective

Capital allocation discipline

Alignment between incentives, control, and enterprise durability

Bridging capital markets discipline with modern technology, private capital, and global investment ecosystems

Board-Relevant Themes

Across public, private, ESOP, and family-controlled enterprises, I contribute a perspective on:

Capital allocation under uncertainty

Incentive alignment and governance integrity

Risk transparency and early signal recognition

Technology oversight without narrative capture

Preserving enterprise value across generational transitions

The focus is durable value creation — not episodic performance.