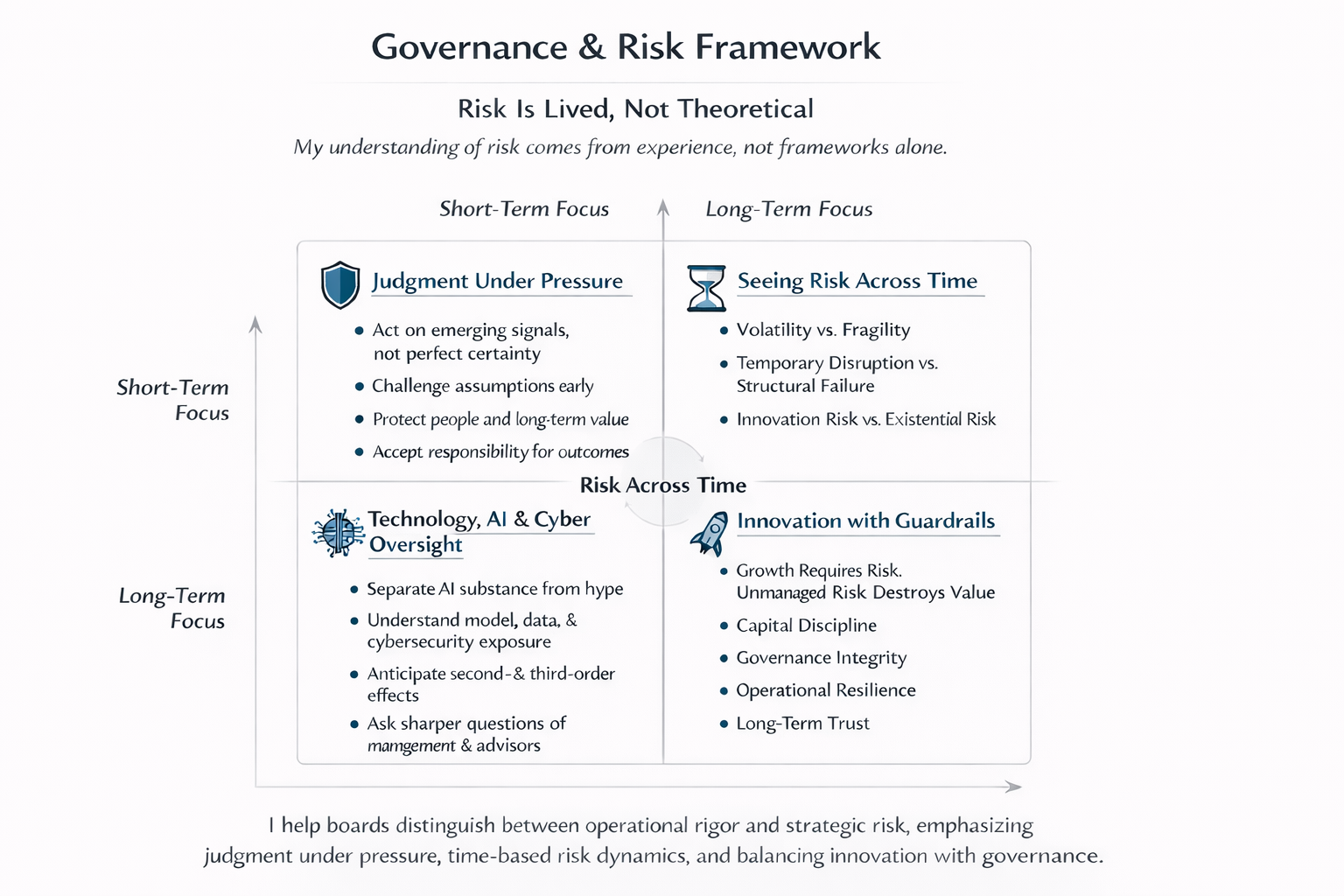

Risk Is Lived, Not Theoretical

My understanding of risk comes from lived markets — not frameworks alone

I’ve made decisions where information was incomplete, time was limited,

and consequences were irreversible

The greatest risks are often the ones assumed away

I help boards distinguish between:

Volatility vs. fragility

Temporary disruption vs. structural failure

Innovation risk vs. existential risk

Risk oversight is not about prediction. It is about judgment under pressure

Judgment Under Pressure

Act on emerging signals, not perfect certainty

Challenge assumptions early

Protect people and long-term enterprise value

Accept responsibility for outcomes

Governance failures are rarely technical. They are usually rooted in incentive

misalignment, oversight gaps, or the failure to act on early signals

Governance & Risk Oversight

Qualified Financial Expert (QFE)

Financial reporting, internal controls, and enterprise risk oversight

FINRA Arbitrator — Financial Industry Regulatory Authority

Adjudicating complex disputes involving broker-dealers,

supervisory structures, regulatory obligations & capital markets practices

Former Registered Broker-Dealer Principal

Responsible for FOCUS filings, audited financials, capital

compliance, and exchange regulatory oversight

These roles reinforce a core belief:

These roles reinforce a consistent belief:

Sound governance is cultural before it is procedural

Technology, AI & Cyber Oversight

I help boards:

Separate AI substance from narrative

Understand model, data, and cybersecurity exposure

Anticipate second- and third-order effects

Ask sharper questions of management and advisors

The focus is governance, incentives, and controls — not tools

Innovation With Guardrails

Growth requires risk. Unmanaged risk destroys value

I help organizations pursue opportunities while maintaining:

Capital discipline

Governance integrity

Operational resilience

Long-term trust

The objective is durable value — not reactive governance.

Risk is lived, not theoretical.

The objective is durable value — not reactive governance

Governance & Risk

Managing Market Risk — XMI Options Pit

American Stock Exchange (AMEX)

Risk is lived, not theoretical. I help boards act before certainty arrives, distinguish

volatility from structural fragility, and oversee technology and AI with discipline

rather than hype. The objective is durable value, not reactive governance

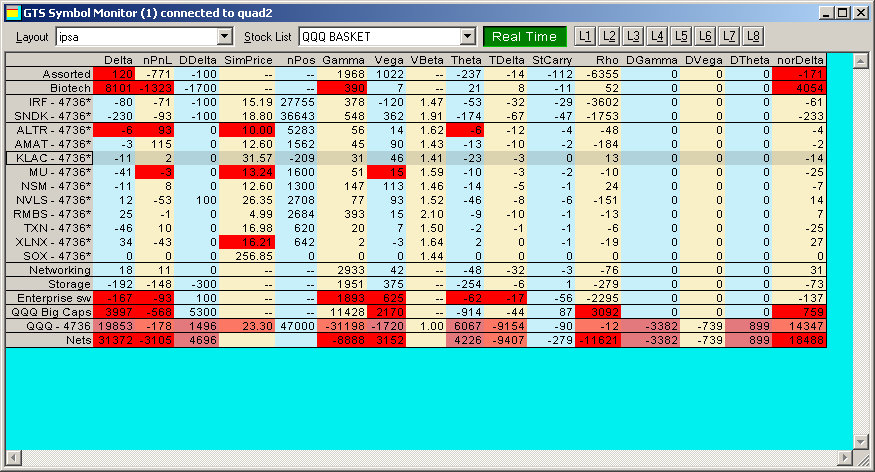

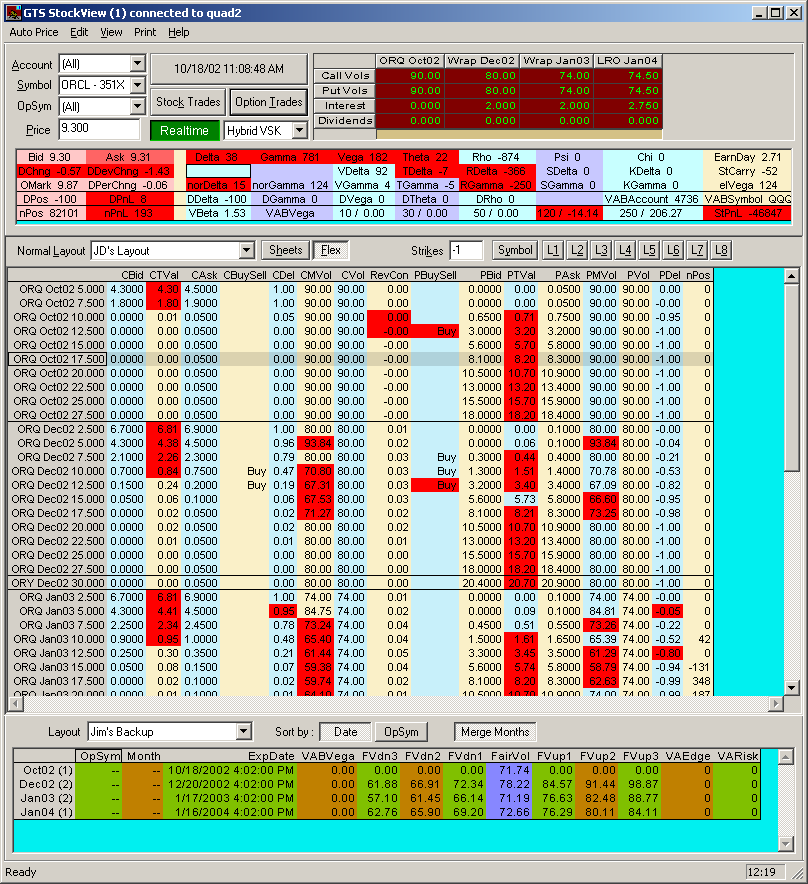

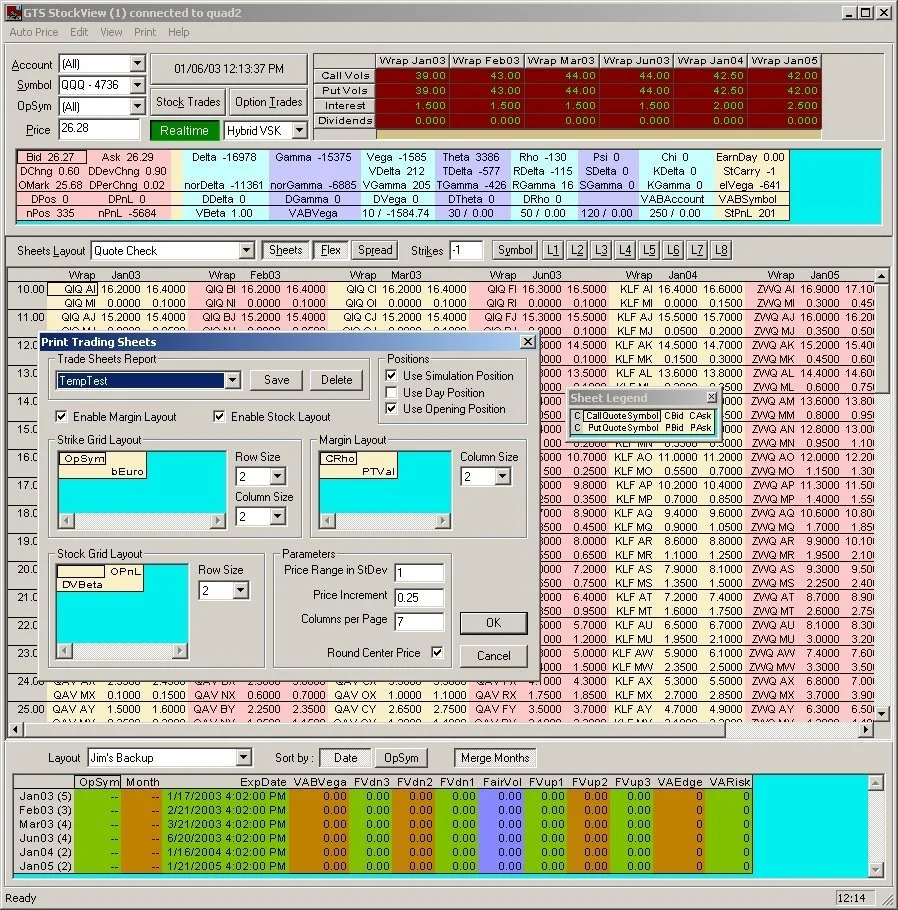

Gateway Trading System (GTS)

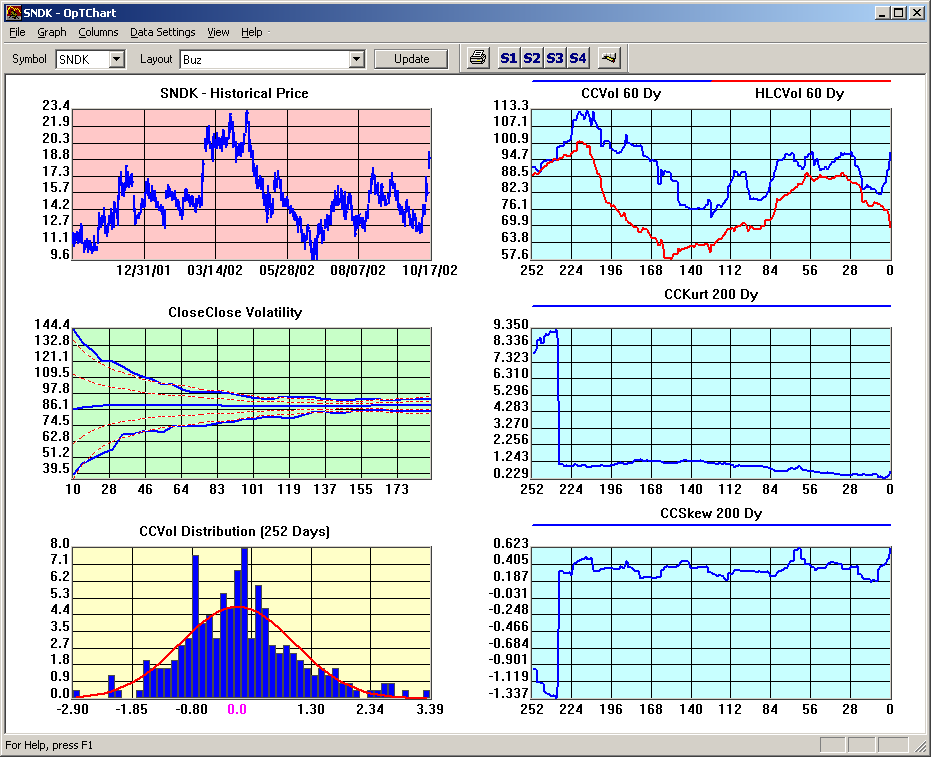

The Gateway Trading System (GTS) was a firm-wide risk architecture I designed and implemented to provide continuous visibility across nearly 500 securities, specialist units, and trading floors

At a time when most clearing reports were static and backwards-looking, GTS enabled real-time monitoring of:

Firm-wide and individual trader exposure

Multi-level risk sensitivities

Portfolio aggregation across time horizons

Directional, volatility, and liquidity exposure

Risk was measured as it evolved — not after damage occurred

This experience informs my board work today:

Risk must be transparent, measurable, and understood across time

horizons before it becomes structural

System Architecture & Oversight Tools

The platform included:

A primary risk dashboard with contract-level and portfolio-level visibility

Real-time aggregation of exposure across positions and symbols

Integrated price, risk profile, and volume visualization

Customizable supervisory views to support disciplined oversight

The objective was simple:

Create firm-wide transparency under dynamic conditions

That same philosophy applies to governance today

Risk must be transparent, measurable, and understood across time horizons

before it becomes structural